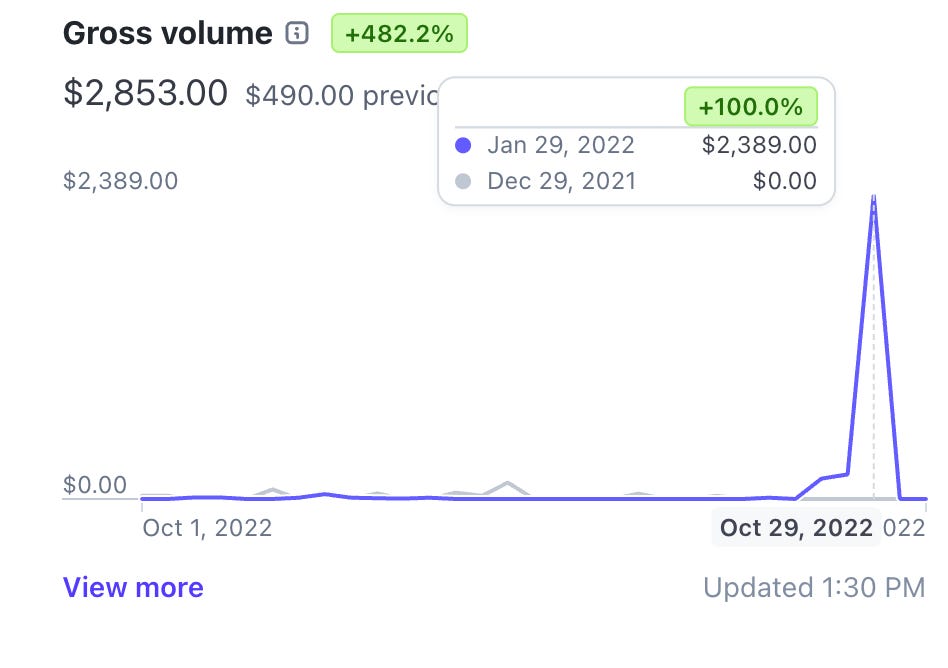

Author’s Note: I recently took a poll to learn whether my community would like for me to write about the role money (or the lack of it) plays in oppressing marginalized people and my journey to financial stability after being laid off in 2020, using $0-startup-cost products and services. Which for me, yielded $600-$2300 a day (stats found in the Freedom From The Feminine Tax chapter) between 2020-2022 before I had a large social media following.

You answered affirmatively, so this work is the first in that series on revenue stream development and financial literacy for women.

TW: The chapters “The Real Wage Gap Is Financial Literacy” and “F*** You Money” briefly mention (with no description) SA and gender-based violence as I share (for the first time - pls be kind) why financial insecurity scared me out of marriage instead of into marriage.

I hope this series helps someone. This article will remain free. Share it with a friend if it’s meaningful and subscribe to read more. <3

During a taxi ride to dinner, a friend of a friend complained that her nana was always insisting that she needed a husband. To which I laughed and said, “she’s not a misogynist, she’s an estate planner. In her day that was called ‘opening a bank account’”. A joke… but no doubt an earnest reminder that many of the elder women in our lives have a very different perspective of relationships and marriage.

And please don’t bite me, but I think girlies in their 20s and 30s could benefit from remembering that not all women who are pro-traditional relationships are pickmes — some are simply making lemonade out of lemons. There is 100% a tax on a husband-free, child-free life — just as there is for women in traditional relationships with men who don’t see them as equals. Single women often carry a financial burden simply for living in a single income household, while partnered women often pay an emotional, physical, and energetic tax… that does eventually become a financial one. See how we all end up in the same place? Why then can’t we all just play nicely?

If either female archetype wishes to avoid the tax… the answer is and always will be money. You don’t get to run from that. All you can do is choose…

How you get it.

What you use it for.

How you store it.

How you grow it.

Finance & Feminism

The fact of the matter is we can’t really discuss feminist advocacy without discussing “the capitalism of it all”.

My issue with “theory-only” social justice warriors is that even when they leave you feeling warm and fuzzy, they usually also leave you with more questions than answers. That boost of “validation serotonin” goes straight to the brain but falls short of solving the problems you face in reality.

The theorists are right, you shouldn’t have to conform to social norms or meet specific performance benchmarks to live a happy, safe, and financially secure life. But until the day that pat on the back successfully topples the shallow, capitalistic society that we live in and contend with daily, you still have to figure out how to survive in this reality. That was really always the point of Girl Boss Feminism™. It was a reminder of the power of financial independence — it was never supposed to be about “becoming the new men”. And albeit at the opposite end of the “financial freedom” spectrum, that’s also the point of the conversations creators like Shera7 put out in the world. In my opinion, neither Girl Boss Feminism™ or Financial Misandry exist to demonize love, it exists to invite you to think critically about the cards you’ve been dealt and how to make the most of it.

And for most of us, this means some level of conformation, whether that’s being a Girl Boss, a City Girl, a Trad Wife, or some alternative form of community, partnership, or family security.

People don’t care about products; they care about people. They care about how you make them feel. When you step into your unique genius, you operate from a place of confidence and authority. This builds trust and it ensures that what you sell is genuinely high-quality.

Freedom From The Feminine Tax Requires Creativity

Independence costs money. But that need not frighten you… I like to approach this as an invitation to get creative. Some people have money because they have privilege, for the rest of us… we survive based on our ability to cultivate creativity.

This was the conversation that inspired this article – soon to be series.

Ever since the pandemic taught me that “safe” jobs aren’t so safe, I have primarily relied on my ability to find creative ways to monetize my knowledge. My greatest gifts are pattern recognition, quickly mastering niche subjects, and communicating ideas. The existence of my large platforms and the money that I’ve generated through them are just natural consequences of those talents being combined. But, as stated in the screenshots… I had to figure out how to monetize BEFORE I reached micro-influencer status.

When I started on Tiktok, I only had 34 followers and they were all people that I knew. I did begin a concerted effort to grow my audience in hopes of creating financial stability - but I still earned my first dollar long before I hit 10k followers. And just as I stated in the first screenshot - it’s difficult to talk about or teach this approach to income creation, because most people just want to complain about their lack of opportunity, privilege, or otherwise when most people who’ve built businesses also started from $0 and 0 followers. It’s easier for them because they already did the hard part. I’ve launched maybe 15-20 different products & services and most of them have made $0.

But you don’t get to the profitable idea or learn the profitable way to market that idea without a flop era. If I had stopped after my first few tries, I’d probably also hold the bitter idea that “everyone isn’t able”. But I mean, you’re right to think that… because not everyone has the emotional regulation required to keep trying in the face of failure and urgent need. I urgently needed groceries and rent covered, so I kept going and learning. I studied my analytics religiously.

I am… getting a bit ahead of myself here, as I only mean this article to be an introduction, our second in this series will cover cultivating creativity to create profitable digital products… but just so you understand where this conversation is going…

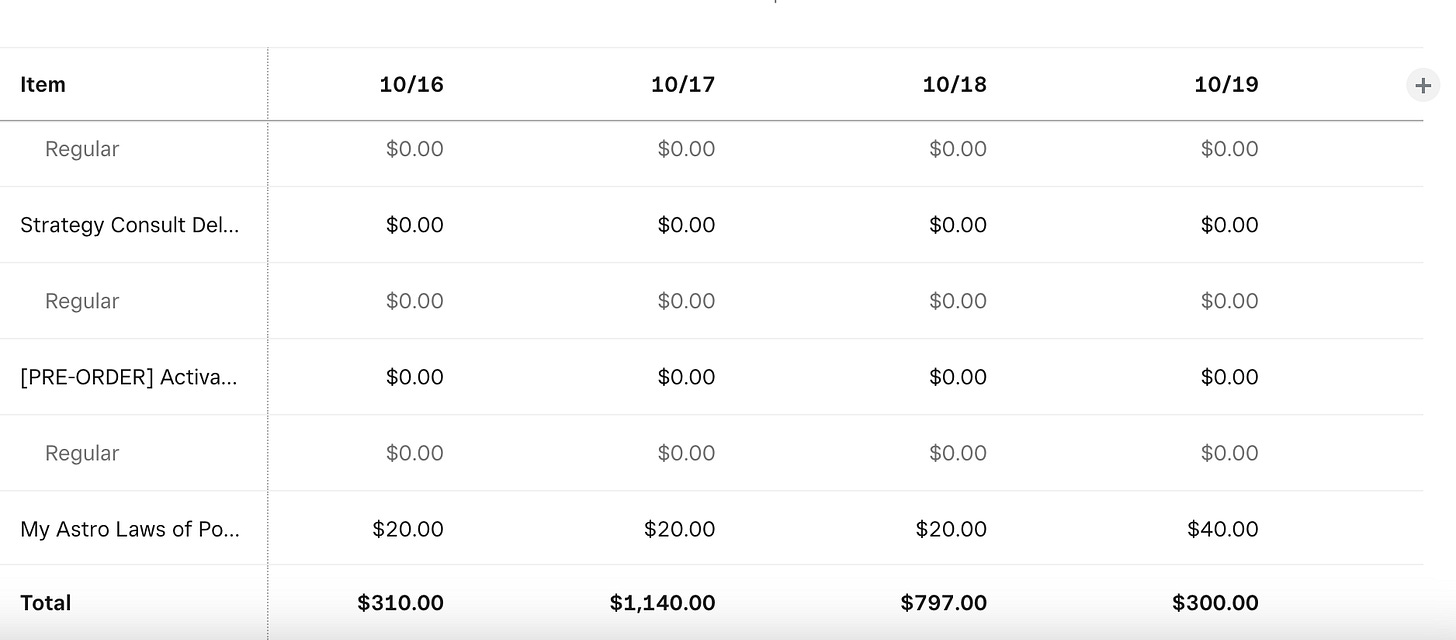

I didn’t have 100K followers on any platform when I was bringing in sales days like this…

But I did have a formal education in business and marketing with agency and public speaking experience… And I used that to turn my niche expertise in herb gardening and astrology into a business that saved my life.

I pivoted, because ultimately my heart wasn’t there in the sense of not wanting my hobby to be my entire career - but it saved me… and it taught me how to apply that creative survival mindset to a business and product suite that better represents how I wanted to be branded. The stats below are from the first digital launch I did for a product that I really believe in and really want to represent who I am and the community I seek to help (The Know Thyself Digital Boundaries Journal) and though every sales day doesn’t look like this - I’d say it did pretty well the week of it’s launch. It went on to cross 5 figures in 8 days.

That’s not to draw your complete focus to money and money alone… if you chase a fast idea it won’t be fast for you. But it is to incentivize you to hear me out as someone who’s studied this, done it professionally for major companies, and done it for themselves from scratch with $0 in startup funding. It’s not about the idea - it’s about you and your expertise.

I couldn’t sell the product that will ultimately work for you and it’s likely that you couldn’t sell the exact same product or service as me. Even if you went into the realm of digital relationship journals, you’d likely have to develop it in a way that speaks to your unique strengths in order for people to care. People don’t care about products; they care about people. They care about how you make them feel. When you step into your unique genius, you operate from a place of confidence and authority. This builds trust and it ensures that what you sell is genuinely high-quality.

Without creativity and critical thought - not overthinking that will keep you stuck - you’ll end up chasing shallow unsellable ideas and miserable for doing so.

This also doesn’t require a large social media presence. Every foremother that started a bakery in her kitchen or a Mary Kay sales business in her living room understood the concept discussed above.

Where do your interests lie? Where’s your expertise? What do people want? [Uncovering this unique place of power was the idea behind my career workbook.]

Learn not to cut yourself off at the knees before even trying just because something requires you to step out of your comfort zone.

Creativity Is An Ancestral Survival Skill. So Use it.

If you belong to a marginalized community, it’s likely that creativity comes to you naturally, as it was often a survival skill of our ancestors. As a Black American lucky enough to have access to the data required to track my ancestors path from being property on a Virginia planation to being sold to the Brown family in Mississippi to their eventual emancipation… I have nothing but hard proof that boldness and creativity in the face of deadly odds is in my veins! And its in yours too.

Your DNA can be traced back to the earliest humans, who faced danger and extinction at every turn, and yet… here you are. What could be more disgraceful than a belief that a single administration and a bad economy could fold the carrier of the ancient DNA of survivors? Don’t be so focused on the doom manufactured to distract you that you relinquish your blood given gift for adapting. That’s how I think about money. It’s a means generated through my ability to adapt that then creates the end goal of freedom… whatever that looks like for me. I exercise my ability to choose the embodiment of conformation that most aligns with me. But I never lose sight of the reality that money always requires a level of conformity. Pick your poison.

Like I said…

If either female archetype (the single woman or the partnered one) wishes to avoid the feminine tax… the answer is and always will be money. You don’t get to run from that. All you can do is choose…

How you get it.

What you use it for.

How you store it.

How you grow it.

I wasn’t trying to be a feminist or a Girl Boss™, I was trying to gain a greater understanding of how not to be f***ed by the people in suits using my art and my body as a means to an end.

The Real Wage Gap Is Financial Literacy

Men know this… they understand the power in not only having money, but the power of having the knowledge required to make the presence of money meaningful. As a young singer-songwriter, I learned hard lessons about the entertainment industry and what it means to be a product. That’s what inspired me to pursue graduate studies in business. I wasn’t trying to be a feminist or a Girl Boss™, I was trying to gain a greater understanding of how not to be f***ed by the people in suits using my art and my body as a means to an end. But I would assert that being a female performer - be you a singer, ballerina (which if you haven’t- look up the history of 19th century ballerinas being exploited), or a poet - is a great metaphor for what its like to be a woman in this world in general. Everybody wants you for your charms, comfort, and body. They’ll build you up in compliments and visibility. But you’ll always have to fight for autonomy over your own body… and your money.

“F**k YOU!” Money changed my life. I didn’t have that term in my vocabulary until years later when I discovered an old Lucy Liu interview… but I learned the concept of F*** You Money (FYM) on my first date, as a teenager.

It’s not enough to have knowledge if you don’t have a blueprint for applying it

F*** You Money

Just before my date pulled into the driveway, my father handed me a roll of 20s and said, “If at any point you want to leave, you use this to pay your bill and call a cab. You can call me if you want. But I rather you show him you don’t need his money.” It was implied, but it was my first lesson in the politics of relationships and money. No money = endure whatever the man you’re with puts you through. Have money = leave at your will if needed/freedom to enjoy the date more if it’s great because the god of “choice” is in your wallet.

I never forgot that.

Maybe even to my detriment. We can debate whether the ultimatum should or should not have existed, but it did… I had a choice to follow in the footsteps of my two college roommates and get married after undergrad or to move overseas and participate in the world’s number one Entertainment Business program… and I chose the latter. I wanted to feel like a self possessed human being before being someone’s wife.

I didn’t know I had childhood trauma, I didn’t know my experiences were “abuse”, I didn’t know that what had happened between me as a sophomore and that upperclassman - for 3 years - was me being sexually assaulted, I didn’t have a single framework for my experiences, but I knew something was wrong with me. I knew something inside of me felt empty, confused, and lost. And that was enough for me to not want to be a bride.

It’s not that I thought a degree would “fix” me. But I did think more life experiences would give me an opportunity to learn more about myself. My college sweetheart didn’t know about the damage - beyond the over-the- phone screaming matches he overheard between my mom and I - because I didn’t know it was damage, to share it as such, to begin with. So, it’s not that he wasn’t understanding, it’s that there was no material to understand, just a girl that he loved constantly saying “no”.

By the time I’d graduated college, we were living together… in his townhouse. I was excruciatingly aware that my ability to survive depended on the success of the relationship and that frightened me. To marry him then - I thought (as I still do today) I’d never know if I said “yes” because I loved him or because I was afraid of facing further abuse from my parents. That was a clear ultimatum on my end because I’d already watched a sister 17 years my senior go through the same dilemma. She married as quickly as possible to get away from our parents and remained financially stuck in an abusive relationship until she landed a better job. I still remember reading interview questions to her from across the dinner table to help her prepare. By the time I was graduating college, she was long free, but the memories of her journey would live with me forever.

They always seem like good men until you’re trapped in a home with them with nowhere to go. I was dating a good man. But I was afraid of what I’d learn about him if I married him with no options for anywhere else to go. The son of a dentist and a military officer, feeling financially trapped wasn’t something he could understand. Money meant very little to him because he’d never gone without it. Even then, from the year my mother and I bounced from relative to relative (we were homeless) to the 3 jobs I worked on top of my scholarships and loans just to attend college - my greatest traumas were sponsored by a lack of capital. He thought it was silly of me to not want to be present in the relationship without financial independence (and emotional stability). But as accepting as it felt… it also felt foolish.

Grad school felt like a miraculous 3rd option. No living off of my boyfriend (and my part time cashier job) and no going home to my parents. F*** yeah.

But he viewed it as my final betrayal. And the rest is history, I guess.

There isn’t a single skill I learned in business school that I don’t use every day. From building meaningful networks, creating and launching products with little to no capital, marketing myself, my business, and my content in ways that drive real revenue, to managing both business and personal finances, and even leveraging debt to generate profit—choosing school gave me the power to choose independence, come rain or shine. And let me tell you, it has RAINED.

But I’m still here—thanks entirely to sheer willpower and the creativity and power of what’s in my brain. Both matter. It’s not enough to have knowledge if you don’t have a blueprint for applying it. I spent a year in entrepreneurship courses learning how to pitch investors—then actually pitching them and applying to incubators. I studied product development then actually built the products. I learned project management then ran real projects. I studied statistical analysis and built models and forecasts myself. That experience taught me to be both a thinker and a doer.

And that comes before making money from scratch (knowing how to apply knowledge). And it also comes before learning how to invest well and use contract law to protect and grow your assets. A Hard lesson for me as I was constantly going broke no matter how much money I made, until late 2023 when I decided to downsize my living and focus on paying off debt.

Red or Blue Pill?

So here’s what I want to do (with this mini series) if you can allow yourself not to get too hung up on “the promotion of capitalism”… If you’re a woman with steady income & assets I want to teach you the basics of finance - how money begets money when you know what to do with it…

If you’re a woman looking for a lifeline, I want to teach you how to use what you already have expertise in to build a product or service that gives you a financial cushion… either until a big break in the work force comes along or until you develop a plan for a more formal business, like I did.

When it comes to the business and finance world… Women are encouraged into the fields of communication, marketing, and PR because they see it as the “waitress work” of the business world. Finance: financial analysts, venture capitalist, startup developers, portfolio managers and bankers are seen as roles for men because there’s a belief that’s where the real power is. The same is true of growth marketing, which is like the super child of marketing and data analyst work.

But you’re not just a mouthpiece. Without the right communication and packaging aesthetic, sales don’t get made. I want to take you from idea – to conception – to communication/broadcast. To teach you how to own the complete “direct-to-customer” flow. When I was laid off in 2020 - I had been working as the head of digital marketing. I was what made sales possible for mega corporations. It made sense to me to get on the internet and become the marketer, the marketing, the product, and the company. F*** the middle man when I’m the woman making the world go round.

I can’t give you a COMPLETE and TOTAL education in 2-3 articles or however long this mini series will be… but I have 10ish days left in my daily writing challenge and a lot to say about the role money HAS to play in social revolutions so I’m going to give you the best introduction that I can.

When I started on Tiktok I had 30ish followers, an average apartment, a broke lifestyle, and an indoor garden that I couldn’t shut up about. And that’s all I needed to create a product that kept my lights on. I learned from that product launch and I began launching others… most of those flopped but it didn’t matter because all you need is one product that works. By the end of that first year I had four prototypes and one product that brought in between $400 - $700 a day.

It took a year… even as someone with a degree and work experience in marketing… but I don’t know any other work that would have taken me from making $15 (honestly $0 to start) a day to $700. With no other options on the horizon, yeah I’ll take a year to figure that out. That is to say… Applying this knowledge may not change your life in 30 days, let alone 10… but the point is to learn it and apply it by owning the principals and practicing the methodology until it does break the world wide open for you. The same is true for investing - but being able to invest starts with having financial security and a surplus cashflow.

If you’re down for the journey say hello below!

This is still primarily my artsy, fartsy, media analyzation and social commentary blog - The Peculiar Creative blog is the home for my business and branding convos. But, my daily writing challenge is here and I want to speak about this from the social-political angle, so for the sake of this “money and feminism” conversation specifically, we’ll discuss business and finances for the girls here for a couple editions.

Author’s note: Thanks for reading! Today marks day 20 of a 30 day challenge to write and publish daily. I’m fighting perfectionism, imposter syndrome, and ADHD freeze one post at a time.

That said, I know everyone may not want a daily Kady essay in their inbox.

I humbly ask that you don’t unsub during this time but to maybe move me to a less disruptive filter if daily contact isn’t your vibe? 😅

But also it would mean a lot to me if you did read each one and checked in!

Share

Previous

Here for the journey and taking notes